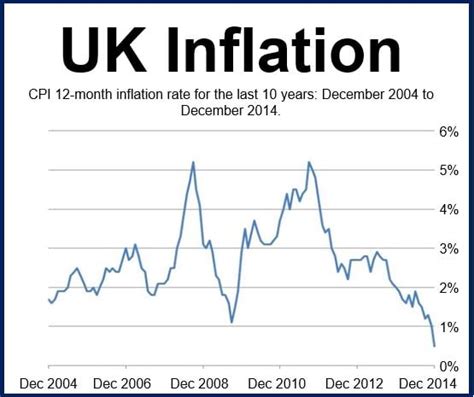

The United Kingdom recently saw a drop in inflation rates for the month of December, catching many by surprise. This unexpected decrease has sparked optimism among investors and economists alike, particularly in light of previous concerns surrounding bond market volatility.

Market Rollercoaster Amid Trump’s Return

As markets navigate through uncertainties, including the return of former US President Donald Trump to the political spotlight, the ebb and flow of economic indicators continues to influence investor sentiments. The interplay between global events and financial markets underscores the intricate balance that shapes our economic landscape.

Amidst these fluctuations, the recent decline in UK inflation offers a glimmer of hope for stakeholders monitoring market trends. By providing a snapshot of consumer price changes, inflation serves as a vital metric for assessing economic health and stability within a country.

The Significance of Inflation Trends

Inflation trends are closely monitored by policymakers and analysts as they reflect underlying shifts in supply and demand dynamics across various sectors. A dip in inflation rates can signal easing pressures on consumer purchasing power, potentially offering relief to households grappling with rising costs.

Experts suggest that the unexpected downturn in UK inflation could have implications for broader economic conditions. While some view this development as a positive turn, others remain cautious amid ongoing uncertainties stemming from geopolitical tensions and policy decisions at home and abroad.

Insights from Economic Analysts

According to leading economic analysts, understanding the nuances of inflation data is essential for gauging overall economic performance. Factors such as wage growth, commodity prices, and central bank policies play pivotal roles in shaping inflationary trends over time.

Furthermore, fluctuations in inflation can impact investment strategies, interest rates, and currency valuations – all of which reverberate throughout financial markets on both local and global scales. Investors are advised to stay vigilant amidst changing market conditions while adapting their portfolios accordingly.

Navigating Volatility Through Informed Decisions

In an era marked by rapid digital communication and interconnected financial systems, staying informed is key to making sound investment decisions. By keeping abreast of market developments and leveraging expert insights, individuals can navigate volatility with greater confidence while seizing opportunities that arise along the way.

As the story unfolds on the global stage with each twist and turn impacting economies worldwide, observers continue to monitor key indicators like inflation rates as barometers of economic resilience. The road ahead remains uncertain yet brimming with possibilities for those who dare to engage thoughtfully with evolving market landscapes.

Leave feedback about this