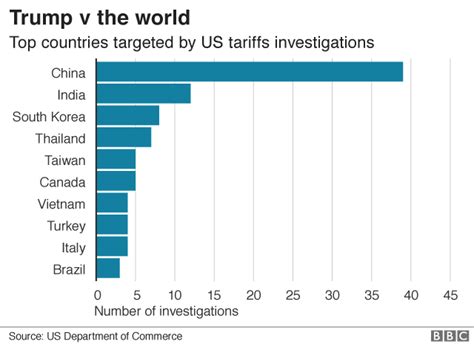

President Trump recently expressed confidence in his tariff plan, despite the recent downturn in US markets. The imposition of tariffs has been a central tenet of his economic policy, aimed at protecting American industries from what he perceives as unfair trade practices by other countries.

Expert Analysis:

Renowned economists have divergent views on the effectiveness of tariffs. While some argue that they can help reduce trade deficits and create job opportunities domestically, others believe that tariffs could lead to retaliatory measures by trading partners, resulting in a global trade war.

To understand the implications of Trump’s tariff strategy, we need to delve into its origins and how it aligns with his “America First” agenda. The President has consistently emphasized renegotiating trade deals to prioritize American interests, even if it means disrupting established trading relationships.

Historical Context:

The US-China trade relationship has been particularly contentious, with accusations of intellectual property theft and unequal market access dominating the narrative. Trump’s decision to end tax exemptions for low-value Chinese imports is another significant step in his efforts to address this issue.

As news of the fall in US markets circulated alongside Trump’s optimistic statements about the tariff plan, investors and analysts were left grappling with uncertainty. Stock prices fluctuated, reflecting the volatile nature of international markets in response to geopolitical developments.

Investor Sentiment:

Market reactions to political decisions are often swift and decisive. Investors closely monitor government policies that can impact industries ranging from technology to agriculture. The unpredictability introduced by tariffs adds another layer of complexity to an already intricate financial landscape.

In interviews with industry experts, concerns were raised about the potential long-term effects of escalating tariffs. Supply chains could be disrupted, consumer prices might rise, and businesses may face increased costs – all factors that could reverberate through the economy.

In-depth Examination:

Looking beyond immediate stock market reactions provides a more nuanced understanding of how tariffs influence various sectors over time. Industries reliant on imported goods may experience challenges while those focused on domestic production could see short-term benefits.

Navigating these nuances requires a delicate balance between protecting domestic industries and fostering global trade relationships. As policymakers continue to debate the merits of protectionism versus free trade, businesses adapt their strategies to remain competitive amidst evolving economic landscapes.

In conclusion, President Trump’s assertion that his tariff plan is ‘going very well’ embodies a complex reality shaped by competing interests and unpredictable market dynamics. The interplay between politics and economics underscores the importance of thoughtful analysis when evaluating policy decisions with far-reaching consequences.

Leave feedback about this