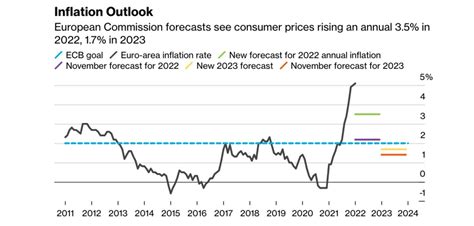

Eurozone is a region comprising of several European countries that share the Euro as their common currency. Inflation, which measures the rate at which the general level of prices for goods and services rises, is a key economic indicator. Recently, there has been news about Eurozone inflation falling to 2.2%. This development has sparked conversations and speculations regarding whether the European Central Bank (ECB) could potentially cut interest rates in response.

Expert Insights:

An expert economist explains, “A lower inflation rate can indicate a slowing economy, as businesses may be reducing prices to stimulate demand. If this trend continues or worsens, it could prompt central banks like the ECB to consider cutting interest rates to encourage spending and investment.”

To understand the potential impact of such a decision, let’s delve into how interest rates influence economic activities within the Eurozone.

The Role of Interest Rates:

Interest rates have a significant influence on consumer spending and investment decisions. When central banks lower interest rates, borrowing money becomes cheaper. This often leads to increased spending by individuals and businesses on things like homes, cars, and equipment. As a result, this upsurge in spending can help boost economic growth.

Conversely, when interest rates are raised, borrowing costs increase. This can deter people from taking out loans for large purchases or investments since they would end up paying more in interest over time.

Challenges Faced by Central Banks:

Central banks face the ongoing challenge of balancing various factors like inflation levels, employment rates, and overall economic growth when making decisions about monetary policy adjustments. A nuanced approach is necessary to ensure stability while fostering financial prosperity.

Against this backdrop of considerations lies the question: should the ECB decide to cut rates in response to decreasing inflation?

Potential Implications:

If the ECB opts for an interest rate cut in light of falling inflation numbers, it could signal an attempt to spur economic activity within the Eurozone amid concerns about a slowdown. By making borrowing cheaper, consumers might feel encouraged to spend more while businesses could find it easier to invest in expansion projects.

However, there are risks associated with lowering interest rates too aggressively or prematurely. It could lead to issues like asset bubbles or excessive debt accumulation if not managed carefully.

In conclusion:

The dynamics between inflation trends and central bank policies are crucial elements that shape economic landscapes around the world. For stakeholders within the Eurozone – from policymakers and economists to everyday citizens – keeping abreast of developments regarding inflation rates and potential ECB actions remains paramount for informed decision-making.

Leave feedback about this