In the heart of the United Kingdom, a financial storm is brewing. The once-stable economic landscape is facing a new threat – rising borrowing costs that loom ominously over governmental affairs and public welfare alike. But why should everyday citizens care about this seemingly abstract issue? Let’s delve into the intricacies and unravel the implications of these escalating expenses.

The Burden of Borrowing

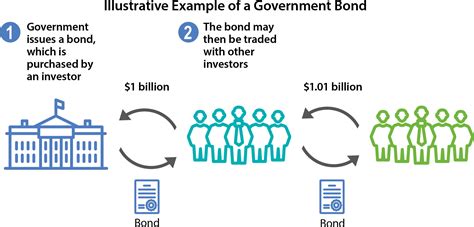

The concept of borrowing costs may sound like a concern reserved for policymakers and financial experts, but its ripple effects extend far beyond boardrooms and trading floors. At its core, rising borrowing costs mean that it becomes more expensive for the UK government to borrow money through issuing bonds. This uptick in expenses can strain national finances, leading to budgetary constraints that ultimately impact public services, infrastructure projects, and social welfare programs.

Unraveling the Causes

To understand why borrowing costs are on an upward trajectory, one must look at a confluence of factors at play. Economic uncertainty, inflation fears, and market speculation all contribute to this phenomenon. As global events unfold with unpredictable outcomes – such as political shifts or natural disasters – investors grow cautious. In response to this uncertainty, they demand higher returns on investments in government bonds, driving up borrowing costs for countries like the UK.

Expert Analysis

Insights from financial analysts shed light on the intricate web of implications woven by rising borrowing costs. According to experts in the field, these elevated expenses could lead to a domino effect across various sectors of the economy. From reduced government spending on critical services to potential tax hikes for citizens, the repercussions are manifold.

Renowned economist Dr. Morgan Davies explains: “The surge in borrowing costs not only burdens government coffers but also trickles down to businesses and consumers. As interest rates climb, companies face higher loan repayments which may impede expansion plans or lead to price hikes on goods and services.”

Balancing Act

In response to this looming crisis, policymakers find themselves walking a tightrope between fiscal responsibility and economic stability. While cutting back on spending could help alleviate some pressure on borrowing costs in the short term, it risks stunting growth prospects and exacerbating social inequalities in the long run.

Moreover, amidst whispers of potential tax increases or austerity measures looming on the horizon, citizens brace themselves for possible impacts on their livelihoods. The delicate dance between addressing immediate financial challenges and fostering sustainable growth remains at the forefront of governmental decision-making processes.

Looking Ahead

As clouds gather over the UK’s financial future, proactive measures are imperative to navigate these turbulent times successfully. Collaborative efforts between policymakers, economists, and stakeholders from all walks of life hold promise in charting a course towards economic resilience.

While uncertainties abound in today’s complex economic landscape, one thing remains clear – understanding the nuances of rising borrowing costs is not merely an exercise in fiscal literacy; it is an essential tool for every citizen invested in shaping a prosperous tomorrow.