Amid a flurry of political maneuvering, Republicans are forging ahead with a bold plan that could reshape the nation’s fiscal landscape. The proposed tax break bill, championed by former President Donald Trump, seeks to usher in significant changes to the country’s taxation system. Coupled with substantial spending cuts, this initiative has sparked heated debates across party lines.

Republican Agenda:

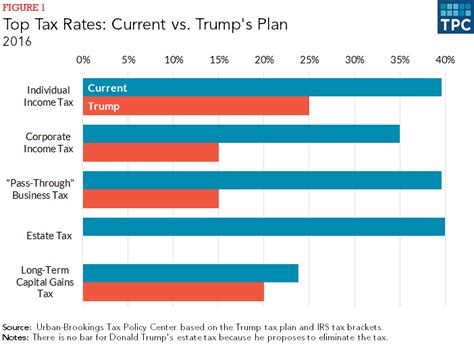

The central focus of the Republicans is to implement tax breaks that aim to stimulate economic growth and boost job creation. By reducing the tax burden on corporations and individuals, they believe that more money will flow into the economy, leading to increased investments and consumer spending.

Controversial Moves:

However, critics argue that such tax breaks primarily benefit the wealthy while potentially depriving crucial government programs of much-needed funding. The simultaneous proposal for extensive spending cuts further exacerbates concerns about widening social inequalities and diminishing support for vulnerable populations.

As discussions unfold within the hallowed halls of Congress, it is evident that both sides are entrenched in their positions. While Republicans tout the potential benefits of their proposed measures, Democrats remain wary of potential repercussions on social welfare programs and income equality.

Expert Insights:

Dr. Emily Carter, an esteemed economist, views this development as a pivotal moment in economic policy-making. According to her analysis, while tax breaks can inject momentum into economic activities, their effectiveness largely depends on how they are structured and implemented.

In a recent interview with CNN Money, Dr. Carter emphasized the need for comprehensive evaluation before rolling out sweeping changes like those proposed by the Republican camp. She cautioned against overlooking long-term consequences in pursuit of short-term gains.

The Political Landscape:

Against a backdrop of heightened political tensions and ideological clashes, the battle over tax reforms has become emblematic of deeper divisions within American society. With each party staunchly defending its stance, finding common ground seems increasingly elusive.

The looming specter of partisan gridlock threatens to stall progress on critical economic issues as policymakers navigate treacherous waters fraught with competing interests and divergent ideologies.

Future Implications:

As lawmakers gear up for intense negotiations and deliberations on Trump’s tax break bill and accompanying spending cuts, all eyes are on Capitol Hill. The outcome of these deliberations could have far-reaching implications for the country’s financial health and socio-economic fabric.

Whether these moves will herald a new era of prosperity or sow seeds of discord remains uncertain. What is clear amidst all uncertainties is that decisions made today will shape tomorrow’s realities for generations to come.

Leave feedback about this