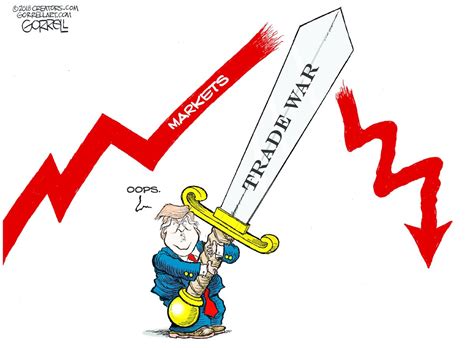

In the world of international trade, decisions made by global leaders can have a ripple effect on economies and financial markets worldwide. Recently, President Donald Trump found himself at the center of a storm as he doubled down on his tariff plans, sparking concerns about potential market turmoil.

As stock futures took a nosedive, signaling an impending market sell-off, the President drew a metaphorical comparison between his tariff policies and taking medicine. “I don’t want anything to go down, but sometimes you have to take medicine to fix something,” Trump candidly shared with reporters aboard Air Force One.

Amidst speculations that his actions could trigger significant market disruptions, Trump reassured the public that despite uncertainties in the markets, the country’s economic foundation remained robust. Expert analysts weighed in on this analogy, highlighting the complexities of international trade dynamics and how drastic measures such as tariffs could be perceived as necessary albeit painful remedies for addressing economic imbalances.

Expert Insight:

Renowned economist Dr. Alex Summers noted that while tariffs can serve as tools for protecting domestic industries and jobs, their implementation often comes with short-term challenges such as increased prices for consumers and market volatility. He emphasized the delicate balance required in trade policies to achieve long-term benefits without causing undue harm.

The White House’s stance on potential short-term consumer impacts contrasted with Trump’s unwavering belief in the efficacy of tariffs as a solution rather than a political maneuver. Despite criticism suggesting otherwise, the President reiterated his commitment to leveraging tariffs for what he viewed as vital negotiations on behalf of American interests.

As U.S. stock futures plummeted over the weekend following Trump’s tariff rhetoric, concerns mounted about a continuation or acceleration of last week’s market downturn. The unfolding events prompted reflections on how geopolitical decisions intertwined with economic policies could sway investor sentiment and financial stability across borders.

In-Depth Analysis:

Financial analyst Sarah Chang delved into the intricate web of interconnectedness among global markets and highlighted how uncertainty stemming from trade disputes could trigger widespread repercussions beyond national boundaries. She underscored the importance of clear communication and strategic foresight in managing market expectations amidst volatile conditions.

While navigating escalating tensions over tariffs, President Trump managed to find some leisure amidst the chaos by participating in a Florida golf tournament—a move that garnered mixed reactions amid escalating economic uncertainties. His social media presence also stirred discussions as he encouraged Americans to stand firm despite turbulent market conditions through posts on Truth Social.

Furthermore, Trump’s engagements with European and Asian leaders along with tech industry stalwarts hinted at behind-the-scenes dialogues shaping international trade strategies. The anticipation surrounding his meeting with Israeli Prime Minister Benjamin Netanyahu underscored potential discussions around reciprocal tariffs imposed on Israel—a topic of keen interest for both nations.

Key Takeaways:

1. International trade intricacies often necessitate tough decisions like imposing tariffs.

2. Market reactions to policy shifts reflect interconnected global financial landscapes.

3. Balancing short-term challenges against long-term gains is crucial in trade negotiations.

4. Personalities play pivotal roles in shaping diplomatic ties amid economic uncertainties.

As Monday loomed with prospects of significant market movements tied to U.S. tariff policies, stakeholders braced themselves for potential aftershocks echoing far beyond national borders. The evolving narrative underscored not just economic ramifications but also geopolitical reverberations triggered by decisive actions taken at pivotal junctures in international relations.

Through navigating these turbulent waters shaped by contrasting viewpoints and divergent priorities, one thing remained clear—the impact of global tariffs extended far beyond mere numbers on trading boards; they carried implications reaching deep into societal fabrics worldwide where livelihoods intersected with policy imperatives in an intricate dance defining contemporary geopolitics.