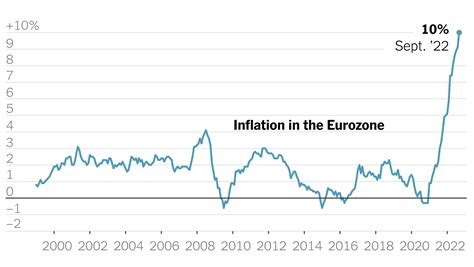

In the bustling arena of global economics, where numbers dance around like elusive fireflies in a moonlit garden, one figure often stands as a lighthouse amidst the tumultuous sea of data – inflation rate. Recently, the Eurozone witnessed a notable event that sent ripples through the financial world – a decline in inflation for the second consecutive month to 2.2%.

Expert Insights:

As economists and market enthusiasts scrambled to decipher this development, whispers of speculation floated in the air like dandelion seeds on a breezy spring day. What could be driving this downturn? Was it merely a temporary blip on the radar or did it signify deeper underlying issues within the Eurozone’s economic landscape?

To unravel this enigma, we must first understand what inflation represents. At its core, inflation is akin to a hidden tax that stealthily erodes the purchasing power of money over time. When prices rise across goods and services, each unit of currency buys less than before – leading to diminished economic growth and stability.

Context Matters:

Against this backdrop, let’s delve into why Eurozone’s recent dip in inflation has garnered attention and raised eyebrows across boardrooms and trading floors alike. The European Central Bank (ECB), tasked with maintaining price stability within the Eurozone, closely monitors inflation trends as part of its mandate.

With inflation slipping below the ECB’s target rate of around 2%, questions arise regarding potential impacts on monetary policies and interest rates. As central banks navigate these uncharted waters, investors brace themselves for possible repercussions on asset valuations and market dynamics.

A Closer Look:

Peering through the looking glass of economic indicators, experts scrutinize various factors contributing to this downward trend in Eurozone’s inflation rate. From volatile energy prices to shifting consumer behaviors amid evolving market conditions – each piece of this complex puzzle adds depth to our understanding.

Moreover, external influences such as global trade tensions or geopolitical uncertainties can cast looming shadows over regional economies, nudging inflation rates one way or another like unseen puppeteers pulling strings behind velvet curtains.

The Human Element:

Beyond numbers and graphs lies a human element intertwined with every economic fluctuation – real people grappling with real consequences. For consumers, lower inflation may spell relief as pockets feel slightly fuller when making everyday purchases.

Conversely, businesses tinker with pricing strategies while policymakers juggle intricate policy decisions in an intricate dance aimed at maintaining equilibrium amidst turbulent economic waters.

As days turn into weeks and months unfurl their tapestries woven with uncertainties and surprises, only time will reveal whether Eurozone’s current dalliance with lowered inflation is but a fleeting affair or harbinger of deeper shifts on the horizon.

In conclusion, while numbers capture moments frozen in time like snapshots in an album, they also serve as breadcrumbs leading us down paths of exploration and discovery within the labyrinthine realm of global economics. So let us embark on this journey together – navigating twists and turns as we unravel tales hidden beneath seemingly mundane digits.

Leave feedback about this