The world of crude oil witnessed a dramatic turn of events recently, as prices spiraled downward amidst a flurry of geopolitical maneuvers. Let’s delve into the intricate web of factors that led to this tumultuous situation.

Trump’s Tariff Tremors

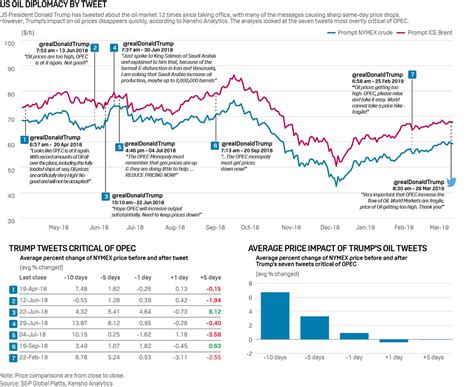

President Trump’s announcement of reciprocal tariffs sent shockwaves through global markets, triggering a chain reaction that reverberated in the energy sector. The fear of an impending trade war loomed large, casting a shadow over the stability of oil prices.

OPEC’s Production Puzzle

Adding fuel to the fire was the unexpected decision by OPEC and its allies to ramp up production levels significantly. This move came as a surprise to many, exacerbating an already volatile market environment.

The Price Plunge Saga

In the aftermath of these developments, crude oil futures nosedived to multi-year lows, erasing gains fueled by geopolitical tensions earlier in the year. Benchmark prices like Brent and West Texas Intermediate (WTI) bore the brunt of this downturn, painting a grim picture for investors and industry players alike.

Expert Insights:

Analysts believe that the combination of heightened production levels and tariff uncertainties has created a perfect storm for oil markets. The delicate balance between supply and demand seems to have been disrupted, leading to widespread apprehension among stakeholders.

OPEC’s Strategic Maneuvering

The decision by key OPEC members to boost output raised eyebrows across financial circles. The intricacies of this move, including its timing and implications for global supply dynamics, sparked intense speculation about future market trends.

As per OPEC’s official statement, this increase in production is part of a broader strategy aimed at stabilizing oil markets amidst evolving economic conditions. However, concerns linger about the potential ramifications on pricing mechanisms and industry equilibrium.

Geopolitical Chessboard

Beyond OPEC’s internal dynamics, external factors such as President Trump’s tariff threats against major oil-producing nations like Russia, Iran, and Venezuela have added another layer of complexity to the situation. The specter of supply disruptions looms large on the horizon, raising questions about sustainability and resilience in an increasingly interconnected world.

Insightful Analysis:

Industry experts caution that any disturbances in the flow of Venezuelan or Iranian oil could have far-reaching consequences for global energy security. The delicate interplay between political posturing and market forces underscores the fragility inherent in today’s oil landscape.

In conclusion, the confluence of OPEC’s strategic recalibration with external pressures from tariff wars paints a picture of uncertainty within the realm of crude oil trading. As stakeholders brace themselves for potential aftershocks from these seismic shifts in policy and pricing dynamics, one thing remains clear – adaptability will be key in navigating these uncharted waters effectively.

Leave feedback about this