The European Central Bank (ECB) recently released minutes from its latest meeting, revealing a deep dive into the intertwined worlds of economics and geopolitics. As policymakers gathered to discuss the current state of affairs, a mosaic of concerns emerged, painting a nuanced picture of the challenges ahead.

Economic Reflections:

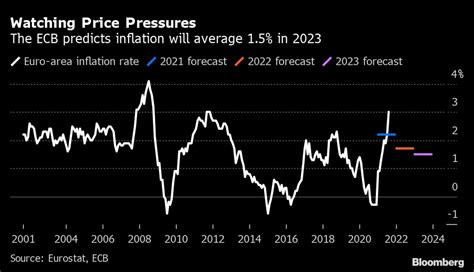

Amidst the backdrop of global economic uncertainty, the ECB deliberated on the outlook for growth and stability within the Eurozone. With inflation rates fluctuating and trade dynamics shifting, members voiced both caution and optimism about navigating these turbulent waters.

Expert Analysis:

According to leading economists, the ECB’s focus on economic indicators reflects a broader trend in central banking circles. By closely monitoring these metrics, policymakers can craft informed strategies to bolster financial resilience and mitigate potential risks.

Geopolitical Complexities:

Beyond economic matters, geopolitical risks loomed large on the ECB’s radar during their discussions. From trade tensions to political upheavals, uncertainties stemming from various regions added layers of complexity to their decision-making processes.

Insider Perspective:

Insiders reveal that geopolitical factors are increasingly shaping monetary policy decisions worldwide. The interconnected nature of today’s global landscape underscores the need for central banks to factor in such external influences when charting future courses.

As minutes were scrutinized line by line, it became evident that the ECB’s balancing act between economic imperatives and geopolitical realities is no easy feat. Each word spoken and each inference drawn carries weight in shaping policies that reverberate far beyond boardroom walls.

Looking Ahead:

Moving forward, market watchers eagerly anticipate how the ECB’s reflections will translate into concrete actions. Will interest rates be adjusted? Are there contingency plans in place to address potential crises? These questions linger as stakeholders brace themselves for what lies ahead.

Strategic Forecasting:

Industry insiders emphasize that understanding central bank deliberations offers valuable insights into future market trends. By decoding nuanced signals embedded within official statements, investors can position themselves strategically amidst evolving landscapes.

In essence, as we dissect snippets from the ECB minutes like archeologists sifting through ancient ruins, we uncover clues that hint at broader narratives unfolding in real-time. The intricate dance between economic data points and geopolitical crosscurrents serves as a poignant reminder of how intricately linked our world has become.