The housing market in the United Kingdom is a fascinating landscape influenced by various economic factors, consumer behavior, and government policies. One key question that often piques the interest of many individuals is,

“What’s the average UK house price?”

This inquiry serves as a barometer for both prospective homebuyers and industry experts to gauge the current state of the real estate market.

Looking at data from May, it is evident that despite fluctuations in other sectors of the economy, UK house prices have displayed remarkable resilience. The stability in house prices can be attributed to a combination of factors such as low mortgage rates, limited housing supply, and shifting preferences among buyers.

According to industry insiders, the recent market data signals a positive outlook for the real estate sector. A prominent real estate analyst noted,

“The consistent performance of UK house prices reflects underlying strength in the housing market. Despite external uncertainties, such as Brexit negotiations and global economic shifts, property values have held steady.”

Delving deeper into the intricacies of the housing market dynamics unveils an interesting interplay between demand and supply. While demand for housing remains robust due to factors like population growth and low-interest rates incentivizing home purchases, the limited supply of housing units exerts upward pressure on prices.

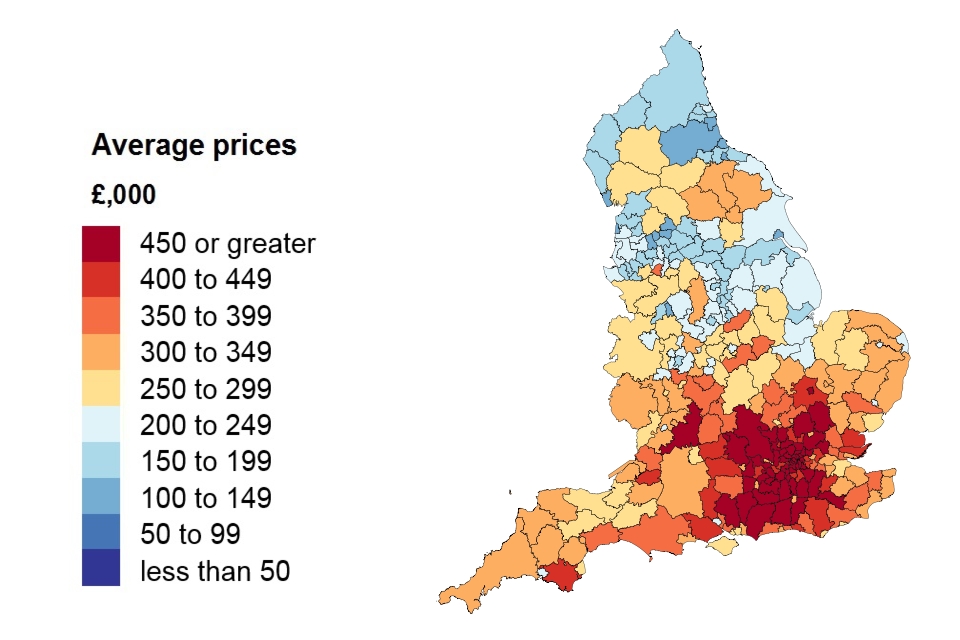

Experts emphasize that understanding regional variations is crucial when analyzing average house prices in the UK.

Different areas exhibit unique trends driven by local economic conditions, infrastructure development projects, and demographic changes. For instance, urban centers may experience higher price growth compared to rural regions due to greater demand for city living and amenities.

In addition to economic drivers shaping house prices, societal trends also play a significant role in influencing buyer behavior. The rise of remote work arrangements following the global pandemic has led some individuals to reassess their living preferences. Subsequently, there has been increased interest in properties with spacious home offices or access to outdoor areas.

As one homeowner shared insightfully about their purchasing decision amid evolving trends:

“I decided to invest in a property outside London after realizing I valued having a garden more than proximity to my workplace. The shift towards remote work made me reconsider what I truly value in a home.”

Moreover, government initiatives like stamp duty holidays and support schemes for first-time buyers have further stimulated activity in the real estate market. These interventions aim to make homeownership more accessible and affordable for aspiring buyers while boosting overall property transactions.

In conclusion, while external challenges continue to impact various sectors of the economy, including Central Asia where deceased donation struggles are prevalent according to health news reports; it is reassuring that average UK house prices display resilience amidst changing landscapes. The intricate tapestry woven by economic fundamentals, consumer preferences, and policy interventions shapes the dynamic realm of real estate – offering both challenges and opportunities for stakeholders navigating this ever-evolving terrain.

Leave feedback about this