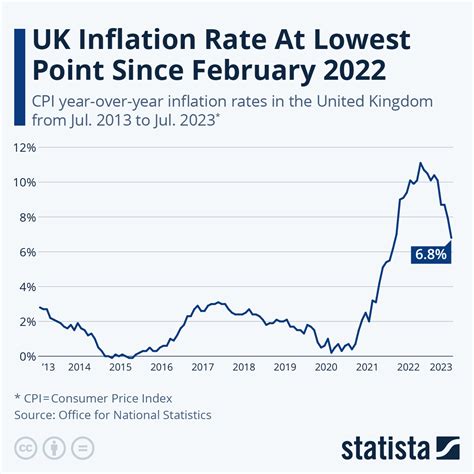

In February, the United Kingdom experienced a significant shift in its inflation rate, which dropped to 2.8%. This sudden decline sparked discussions among economists and policymakers about the potential implications for the country’s economic landscape.

The Significance of Inflation

Inflation is a key economic indicator that measures the rate at which prices for goods and services rise, resulting in a decrease in the purchasing power of a nation’s currency. A high inflation rate can erode consumer confidence, reduce real income, and destabilize financial markets. On the other hand, low inflation can indicate stagnation or deflationary pressures within an economy.

Interpreting the Data

The slowdown in UK inflation to 2.8% has been met with mixed reactions from experts. While some view it as a positive development that could ease cost-of-living pressures for households, others raise concerns about underlying weaknesses in the economy that may have contributed to this deceleration.

Rumors of a Rate Cut

The drop in inflation has fueled speculations about a potential interest rate cut by the Bank of England. Lowering interest rates is one way central banks stimulate economic growth by reducing borrowing costs for businesses and consumers. However, such a move also carries risks, including encouraging excessive lending and potentially fueling asset bubbles.

Expert Insights

Economists are closely monitoring this situation to assess whether the decline in inflation is transitory or signals broader economic challenges ahead. The decision to adjust interest rates involves weighing various factors such as employment levels, productivity growth, and global market conditions.

As discussions unfold around the possibility of a rate cut, financial markets react to any hints or statements from central bank officials regarding their future monetary policy stance. Traders watch these developments closely as they assess how changes in interest rates could impact currency valuations and investment strategies.

Global Perspectives on Economic Trends

Meanwhile, international observers are also observing how events like Brexit negotiations and global trade tensions may influence Britain’s economic performance moving forward. The interconnected nature of today’s economies means that shifts in one region can have ripple effects across continents.

In conclusion, while the decrease in UK inflation to 2.8% has stirred debates about potential rate cuts and economic implications, only time will reveal the true outcomes of these developments on both local and global scales.

Leave feedback about this