Investment in the financial technology sector is soaring, with Fundment making waves by securing a substantial £45M in Series C funding for their innovative platform. The UK alone anticipates an astonishing transfer of £5.5 trillion in assets over the next three decades, highlighting the critical role financial advisers play in managing wealth for future generations.

“Financial advice is a heavily regulated space and it is difficult for fintech platforms to break through unless they truly understand how to manage and enable operations for their customers.” – Ad Ola Abdul, Founder and CEO of Fundment

Fundment’s latest funding round was spearheaded by Highland Europe, with additional support from ETFS Capital. This fresh injection of capital will drive product development initiatives, expand team capabilities, and facilitate global outreach efforts. The core mission of Fundment lies in simplifying administrative tasks for financial advisers while enhancing overall operational efficiency.

In today’s competitive landscape, financial advisers are under immense pressure to deliver personalized services efficiently. The demand for tailored data tracking and analysis tools has never been greater as clients seek bespoke solutions that align with their unique financial goals. Fundment addresses these challenges head-on by offering a comprehensive suite of integrated services that empower advisers to streamline operations seamlessly.

“Financial advisers face a growing need for modern technology to scale amidst increasing client sophistication and regulatory pressure.” – Gajan Rajanathan, General Partner at Highland Europe

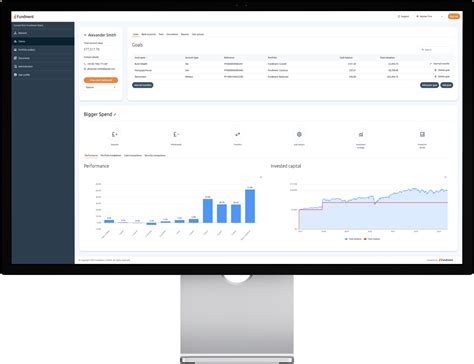

Fundament’s proprietary technology encompasses a wide array of features ranging from core platform services to back-office tools and investment management solutions. By providing secure portals for advisers to oversee investment processes diligently, Fundment ensures adherence to stringent regulations without compromising operational agility.

The staggering magnitude of assets set to change hands globally—estimated at around $68 trillion—underscores the significance of efficient wealth management solutions like those offered by Fundment. High-profile companies such as Legal & General, BlackRock, and HSBC already leverage Fundment’s platform which supports various investment products including OEICs, Unit Trusts, Investment Trusts, ETFs, as well as domestic and international equities.

Ad Ola Abdul reflects on the journey ahead stating: “We now have over 500 firms relying on Fundment but we’re still in the early stages of our journey.” With an unwavering commitment to empowering financial advisory firms through cutting-edge technology solutions, Fundement remains poised for significant growth underpinned by its recent successful funding round.

Gajan Rajanathan highlights the pivotal role played by technology in enabling financial advisers to navigate evolving client demands amidst regulatory complexities. As industry dynamics continue to evolve rapidly, platforms like Fundement stand out for their user-friendly interfaces and transparent approach towards facilitating access to diverse investment options.

As investors increasingly recognize the transformative potential of fintech platforms within traditional sectors such as wealth management, partnerships between innovators like Fundement and venture capitalists are poised to reshape the future landscape of financial advisory services significantly.

Leave feedback about this